Category: Tax Planning

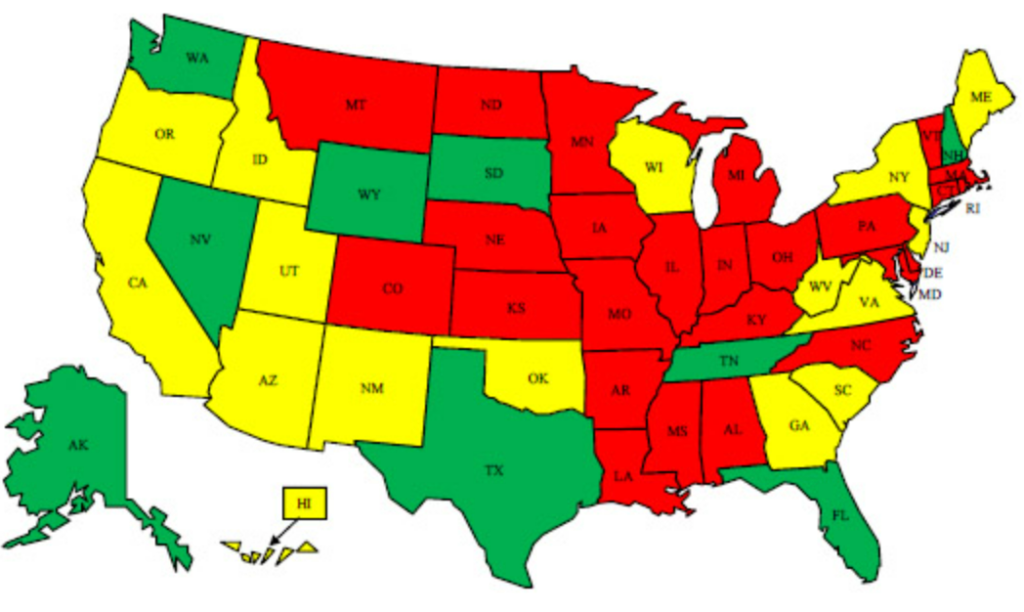

LLC Federal Tax Classification

LLC Federal Tax Classifications are the rules that determine how the IRS treats a Limited…

Annual Benefits Enrollment – What you should know?

Every year, during open enrollment, a person or employee can modify, add, or remove their…

For California storm victims, IRS postpones tax-filing and tax-payment deadline to Nov. 16

IR-2023-189, Oct. 16, 2023 WASHINGTON — The Internal Revenue Service today further postponed tax deadlines…

Businesses must electronically file Form 8300 for cash payments over $10,000

Beginning Jan. 1, 2024, businesses that file 10 or more information returns must e-file Form 8300,…

Certain energy credits under the Inflation Reduction Act are elective pay eligible.

Issue Number: Tax Tip 2023-94 Certain energy credits under the Inflation Reduction Act are elective…

Tax considerations for people who are separating or divorcing.

Issue Number: Tax Tip 2023-97 Tax considerations for people who are separating or divorcing When couples…

Tax to-dos for newlyweds to keep in mind.

Issue Number: Tax Tip 2023-91 Anyone saying “I do” this summer should review a few…

Things for extension filers to keep in mind as they prepare to file.

Issue Number: Tax Tip 2023-92 Many people requested an extension to file their tax return…

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- Next Page »