As a freelancer, small business owner, or “solopreneur,” the Solo 401(k) is arguably your most powerful wealth-building tool. But with great power comes great administrative responsibility. Because you act as both the employer and the employee, it is surprisingly easy to accidentally cross the IRS contribution limits.

If you’ve realized you over-contributed to your Solo 401(k), don’t panic. Whether you exceeded the $23,500 employee limit or the 25% employer profit-sharing cap, here is how to rectify the mistake and stay in the IRS’s good graces.

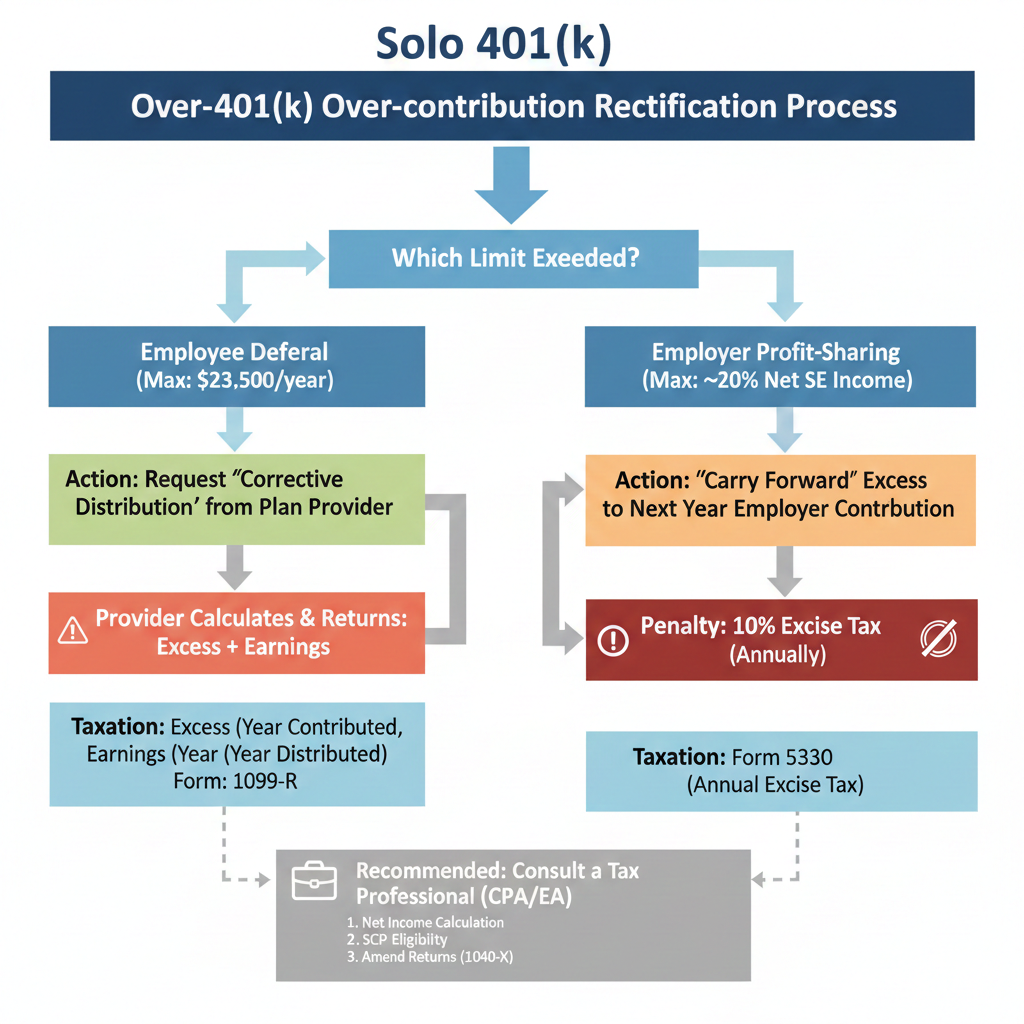

Step 1: Identify Which Limit You Broke

Before you can fix the problem, you need to know which “bucket” the excess money is in. The IRS treats employee and employer mistakes differently.

- Employee Deferral Over-contribution: This happens if you contribute more than $23,500 (for 2025) across all 401(k) plans you participate in.

- Employer (Profit Sharing) Over-contribution: This happens if your business contributes more than 25% of your compensation (or roughly 20% of net self-employment income for sole proprietors).

Step 2: How to Fix Employee Deferral Excess

If you contributed too much of your “salary,” the fix is relatively straightforward—but it is time-sensitive.

The Fix: Request a Corrective Distribution You must notify your plan provider (e.g., Vanguard, Fidelity, or E-Trade) immediately. Tell them you have an “excess deferral.” They will calculate the excess amount plus any investment earnings associated with it and return that money to you.

The Deadline: April 15 You must remove the excess and the earnings by April 15 of the year following the mistake. If you miss this deadline, you face double taxation: you are taxed on the money in the year you contributed it, and you are taxed again when you eventually withdraw it in retirement.

The Paperwork: Your provider will issue a Form 1099-R. The excess contribution is reported as income in the year it was made, while the earnings are reported in the year they are distributed.

Step 3: How to Fix Employer Contribution Excess

Fixing an employer over-contribution is a bit more complex because the IRS generally does not allow these funds to be “un-contributed” or withdrawn.

The Fix: The “Carry Forward” Method Instead of taking the money out, you leave the excess in the account and “apply” it to next year’s contribution limit. This effectively reduces how much you can contribute in the following year.

The Penalty: 10% Excise Tax Because the money stayed in the tax-advantaged account when it shouldn’t have, the IRS charges a 10% excise tax on the excess amount. You must report this using IRS Form 5330. You will continue to pay this 10% tax annually until the excess is fully absorbed by future contribution limits.

Step 4: Consult a Tax Professional

While the steps above are the standard procedures, every business structure (LLC, S-Corp, Sole Prop) has nuances. A CPA or tax advisor can help you with:

- Calculating “Net Compensation”: Ensuring you didn’t miscalculate your profit-sharing cap (which is a common cause of over-funding).

- IRS Voluntary Correction Program (VCP): If the error is significant or several years old, a pro can help you use IRS programs to avoid plan disqualification.

- Amending Returns: If you already filed your taxes and claimed a deduction for the excess, you will need to file Form 1040-X.

How to Prevent Over-funding in the Future

- Use a Solo 401(k) Calculator: Always run your final year-end numbers through a calculator that accounts for self-employment tax deductions.

- Wait Until Tax Time: Many solopreneurs wait until March or April (before filing) to make their “Employer” contribution. This ensures you are using final, audited income numbers.

- Coordinate Multiple Jobs: If you have a W-2 job and a side hustle, remember the $23,500 limit is per person, not per plan.

The Bottom Line

Mistakes happen, especially when you’re wearing the hats of CEO, CFO, and Employee. The key is speed. If you catch an employee deferral error before April 15, the “damage” is usually just a bit of extra paperwork.

HOW SURE FINANCIAL AND TAX SERVICE LLC HELPS?

For assistance in navigating your taxation and foreign financial need and ensuring compliance, consult SURE FINANCIAL AND TAX SERVICES LLC( dba SURYA PADHI, EA). SURE FINANCIAL AND TAX SERVICES LLC have the expertise to guide individuals and businesses through the complexities of tax forms, ensuring accurate completion and adherence to IRS requirements. By partnering with us, individuals and businesses can confidently manage their tax responsibilities while safeguarding sensitive information, thereby ensuring smooth operations and compliance with IRS regulations.Schedule a free 15 minutes meeting with us.

Our Contact : +1 908.955.0696 | contact@suryapadhiea.com | services@surefintaxsvs.com | https://suryapadhiea.com/