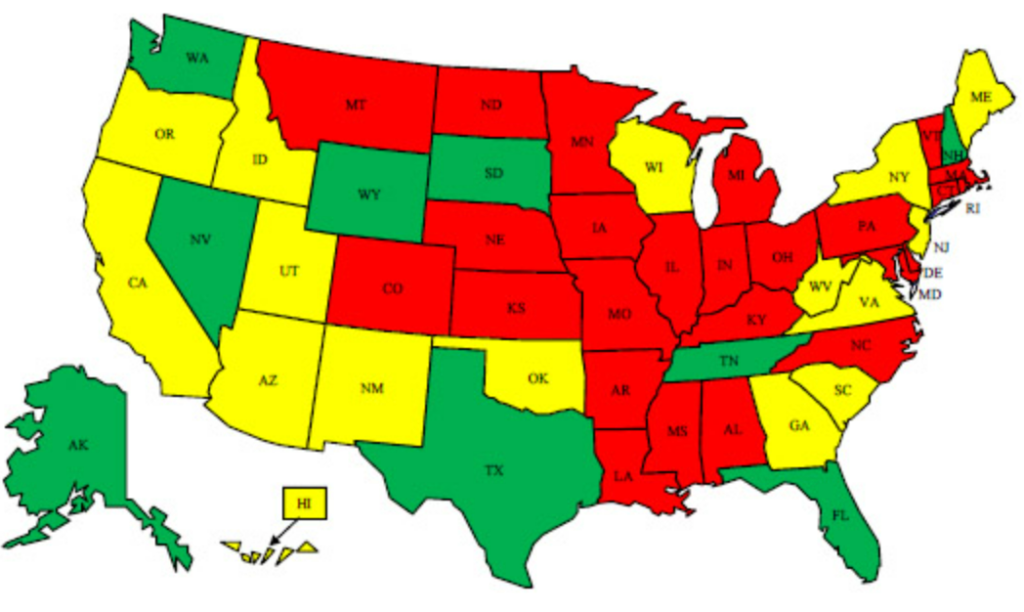

Depending on the state in which you reside, the location of your place of employment & business might require you to pay extra state taxes or even file numerous tax returns within that state. Nine states—Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming—do not compel residents to pay state income taxes on profits from payroll. This is in contrast to the majority of states, which require residents to pay these taxes.

However, if any of the following five circumstances apply to you, you may in fact be required to file a state income tax return—and maybe even in several states.

If you live in one state but work in another, you are said to be commuting.

If you work in a state that is adjacent to the one in which you reside, you could be required to submit state tax returns in both of those states. However, if the state in which you now reside has a reciprocity agreement with the state in which you currently work, you are only required to pay state income taxes in the state in which you currently work.

In most cases, the process will be straightforward and uncomplicated if the state in which you are employed has a reciprocity agreement with the state in which you reside.

You normally have to file a state income tax return just as you would if you worked in your home state, and you may ask your employer to withhold income taxes for the state in where you reside.

Even while many residents of one state commute to jobs in neighboring states, not all of those states participate in the reciprocity program. It is possible that you may be required to take additional procedures in order to submit your income tax return if the state in which you work does not have reciprocity with the state in which you reside.

It is possible that taxes may be withheld from your wages by the state in where you are employed. Additionally, it is possible that you will be required to submit an income tax return with the state in which you are employed even if you do not live there.

In the event that you and your partner are employed in different states.

If you and your spouse file your taxes jointly but work in different places, the majority of the time, the only state tax return you will be required to submit is the one for the state in which you both reside, even if one of your employers is located in another state.

However, depending on the specifics of your situation, you could be needed to submit numerous state income tax filings. This is the situation that arises if one of your employers deducted taxes for a state in which one of you works, but not the state in which you both reside and work. You will need to submit a nonresident state tax return in the state in which you work for the majority of states. You may find out which states took taxes out of your paycheck by looking at your paycheck stub or filling out IRS Form W-2.

However, this is something that has to be considered in light of the fact that each state has its unique regulations for the filing of nonresident tax returns. To reiterate, if you are unclear, you should seriously consider engaging Sure Financial and Tax services to investigate the procedures for paying state taxes in your state.

It’s also possible that the tax department in your state will be able to provide you with some information.

You resided in more than one state.

If you resided in more than one state throughout the course of the same year, you may be required to submit several state tax returns. This may be the case if you worked remotely and had to move between states for your job. Because of this, you can be deemed a resident of each state for just a portion of the year, which might have an impact on the amount of taxes you owe.

A person who migrated and lived in two states during separate periods of the same year is also considered to be a part-year resident of both states. For instance, let’s assume you spent more than five years living in Louisiana, but in June of 2022 you made the decision to move to Georgia with the intention of making it your permanent place of residence. In this scenario, it is possible that both states will need you to file tax returns as a part-year resident of their state.

If You Have Business Operations in Other States

You could be required to submit an extra state tax return if you run a company in a state that is not your home state but in which you maintain a physical presence. For instance, the state of Florida requires company owners who are not residents of the state to file a state tax return if they have workers working for them in the state or if they have a business office there.

In addition, if you conduct a company outside of Louisiana but get revenue from that business in Louisiana, you are still required to file a tax return in Louisiana if you live in Louisiana. It is in your best interest to discover the procedures for filing taxes in your home state as well as any other states in which you conduct business.

If You Have Rental Property in Another State, You Should Read This.

If you own rental property in another state, the location of that property may impact whether or not you are required to pay taxes to that state. It is the law in several states, including Georgia, that non-residents must pay taxes on any rental income they get from property located inside the state. To discover whether or not you are needed to submit state tax returns, it is important to get in touch with the states in which you have rental properties. This is analogous to the situation when you run a company in numerous states.

How To File Taxes in Multiple States

Throughout the year, do your best to pay enough state taxes by checking your tax withholdings. Use an online state tax withholding calculator, or speak with a Sure Financial and Tax Services if you need assistance. If you determine you are not paying enough state taxes, contact your human resources department at work to increase your state tax withholding. If you’re self-employed, you’ll need to pay estimated state income taxes. If you prepare your own taxes, be ready to pay more than someone who has only one state tax return to file.

Let us know if you need any help.

Contact Surya Padhi at Sure Financials for any questions and clarification. Surya Padhi is an expert who keeps current on tax law changes as well as a member of the National Association of Tax Professionals National Association of Tax Professionals (NATP) and National Association of Enrolled Agents (naea.org). Visit Welcome | Sure Financials & Tax Services, LLC (surefintaxsvs.com) for more information and contact us by calling +1 908.300.9193.